special tax notice 401k rollover

Build Your Future With a Firm that has 85 Years of Retirement Experience. If you roll over a payment from the Plan to a Roth IRA a special rule applies under which the amount of the payment rolled over reduced by any after-tax amounts will be taxed.

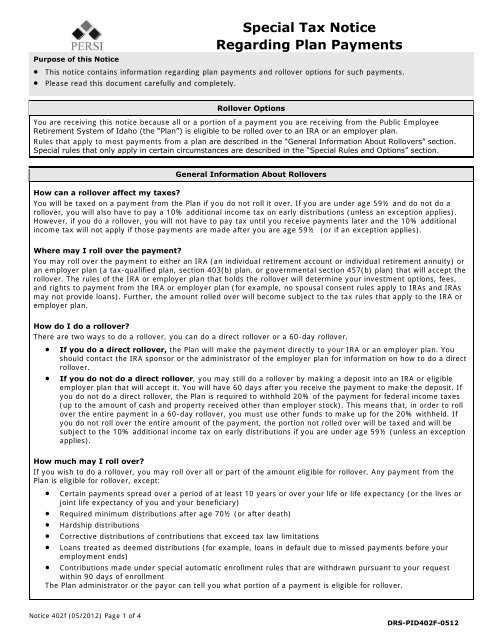

Special Tax Notice 402f Persi Idaho Gov

This notice explains how you can continue to defer federal income tax on your retirement savings in your companys 401 k.

. Schwab Can Help You Make A Smooth Job Transition. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. You may roll over your after-tax contributions to an IRA either directly or indirectly.

Ad Form 5500 IRA 401k Expert Business Valuation 3 days. Ad Gain Access to a Wide Range of Investment Options When you Transfer To a Fidelity IRA. Ad It Is Easy To Get Started.

If you do not roll over the entire amount of the payment the portion not. IRS Model Special Tax Notice Regarding Plan Payments. If you do not roll over the entire amount of the payment the portion not.

Rollover the Plan is required to withhold 20 of the payment for federal income taxes up to the amount of cash and prop-erty received other than employer stock. After-tax Contributions and Roth 401k plan deferrals1 After-taxrollover into an IRA. 59-12 you may have to pay an additional 10 tax.

Special tax notice required by the IRS that explains the tax treatment of your Plan payment that is not from a designated Roth account and describes the rollover options available to you. The attached Special Tax Notice explains the federal income tax consequences of. Order to roll over the entire payment in a 60-day rollover you must use other funds to make up for the 20 withheld.

You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA. Rollover the Plan is required to withhold 20 of the payment for federal income taxes up to the amount of cash and property received other than employer stock. This notice describes the rollover.

If your eligible rollover distribution is not rolled over it will be taxed in the year that you receive it. The Special Tax Notice also called a Rollover Notice or 402f Notice must be furnished to plan participants any time all or a part of a distribution is eligible for rollover. Build Your Future With a Firm that has 85 Years of Retirement Experience.

Ad 10 Best Companies to Rollover Your 401K into a Gold IRA. A 60-day rollover to an employer plan of part of a payment that includes after-tax contributions but only up to the amount of the payment that would be taxable if not rolled over. Order to roll over the entire payment in a 60-day rollover you must use other funds to make up for the 20 withheld.

SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Schwab Has 247 Professional Guidance.

Simplify Your 401k Rollover Decision. SPECIAL TAX NOTICE REGARDING YOUR ROLLOVER OPTIONS You are receiving this notice because all or a portion of a payment you are receiving from the Retirement Systems of. Explore The Advantages of Moving an IRA to Fidelity.

If you do not roll over the entire amount of the payment the portion not. No Upfront Fees No Risk. Rollover the balance and will no longer be invested in the investment options available under the Plan.

Special Tax Notice For 401K Rollovers. Protect Yourself From Inflation. Ad Register and Subscribe Now to work on your IRS Rollover Chart Form more fillable forms.

Ad Build Your Future With a Firm that has 85 Years of Retirement Experience. If you do not roll over the entire amount of the payment the portion not rolled over will be taxed and will be subject to the 10 additional income tax on early distributions if you are under age. You can roll over all or part of the payment by paying it to your traditional IRA a Roth IRA or to an eligible employer plan that accepts your.

Order to roll over the entire payment in a 60day rollover you must use other - funds to make up for the 20 withheld. You are receiving this notice because all or a portion of a payment you are receiving from an Employees Retirement System of Georgia ERSGA plan the Plan is eligible to be rolled. This means that in order to.

This means that in order to. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Reg Bi S 401 K Rollover Obligations Wolters Kluwer

How To Roll Over Your 401 K To An Ira Smartasset

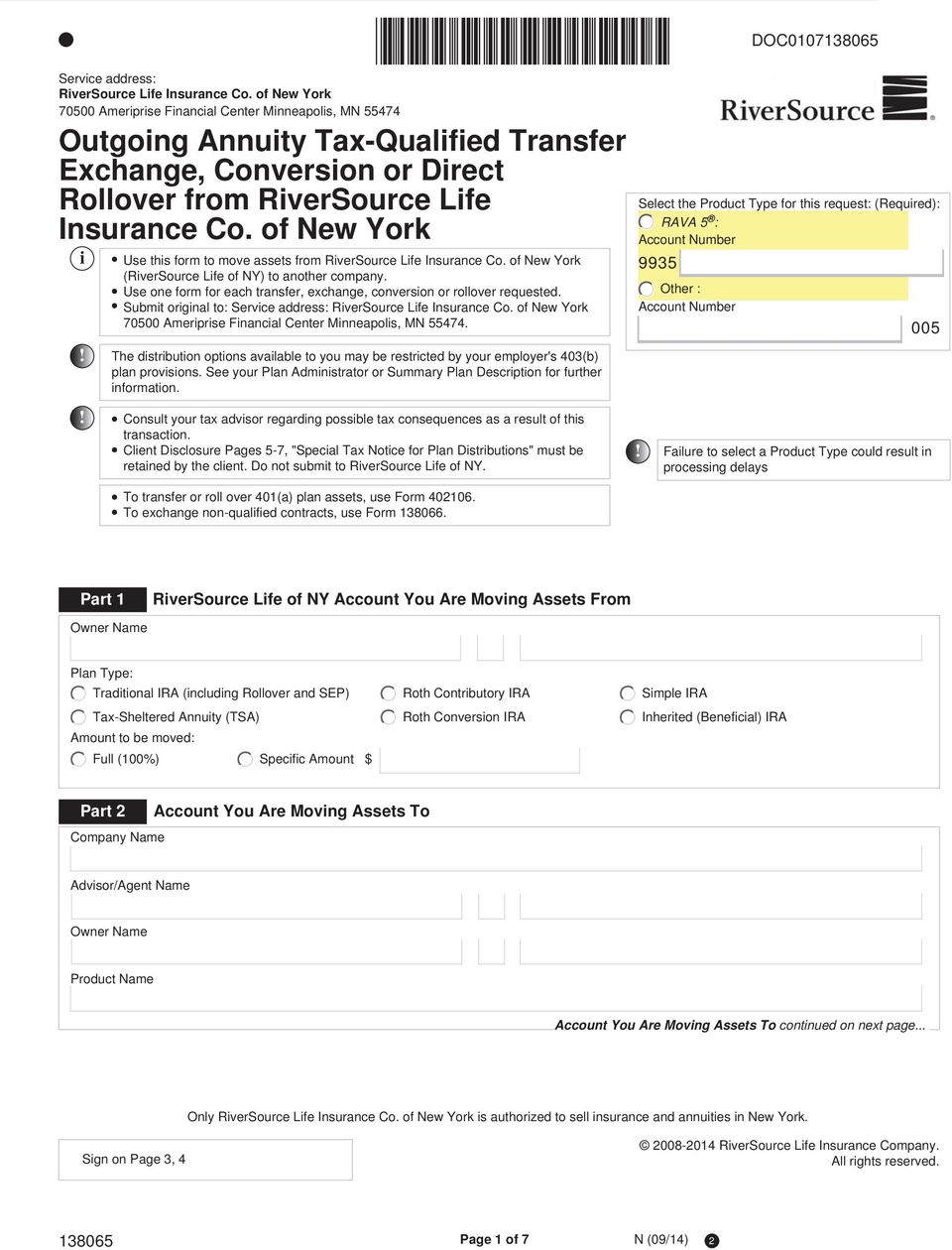

Outgoing Annuity Tax Qualified Transfer Exchange Conversion Or Direct Rollover From Riversource Life Insurance Co Of New York I Pdf Free Download

Do We Have To Provide New Paperwork When A Participant Requests A Second Distribution

Roth Non Roth Termination Form Fill Out Sign Online Dochub

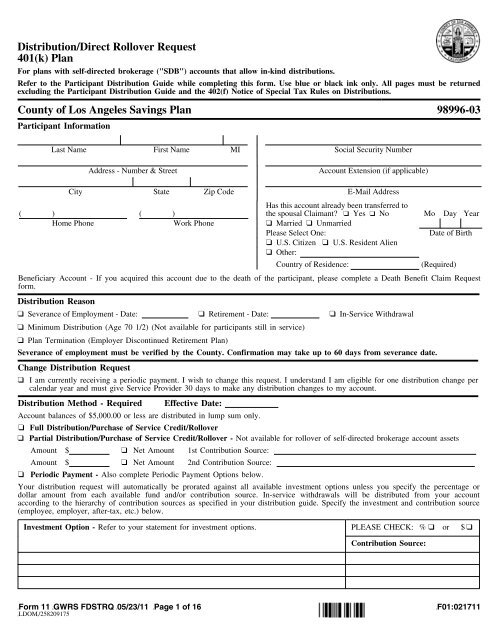

Distribution Direct Rollover Request 401 K Plan County Of Los

Publication 590 A 2021 Contributions To Individual Retirement Arrangements Iras Internal Revenue Service

How An In Service 401 K Rollover Works Smartasset

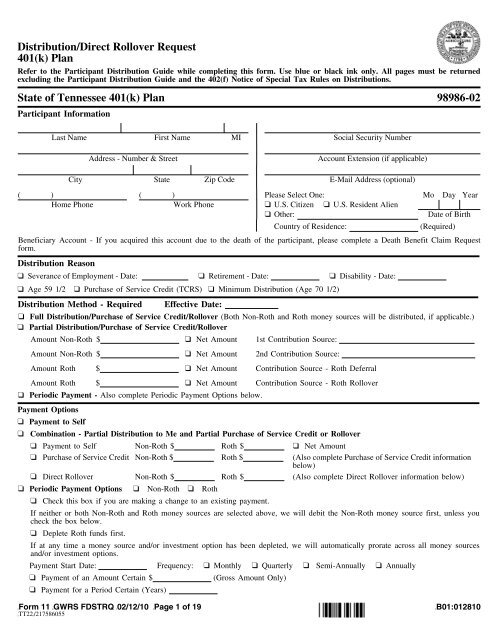

Distribution Direct Rollover Request 401 K Plan State Of Fascore

Yes You Re In The Right Place Welcome To Empower Retirement As You Navigate Your Site You Ll Notice Many Of The Pages Still Have A Massmutual Logo That S Okay It Will Take Some Time To Fully Transition You To The Empower Experience We Look Forward To

Commonly Asked Questions About 401 K Rollovers

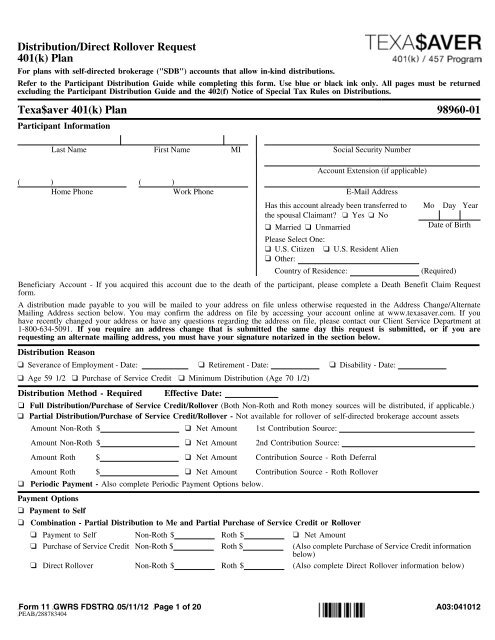

Distribution Direct Rollover Request 401 K Plan Texa Fascore

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information

Special Tax Notice Prudential Retirement

The Right Way To Roll Over Your 401 K And Ira Money Marketwatch

Rollover Archives Retirement Learning Center

:max_bytes(150000):strip_icc()/dotdash_Final_Rolling_Over_Company_Stock_When_It_Does_and_Doesnt_Make_Sense_Nov_2020-01-d8564a6c9cc44d5aa668960b689881bc.jpg)

Rolling Over Company Stock When It Does And Doesn T Make Sense

401k Distribution Request Form Fill Out Printable Pdf Forms Online

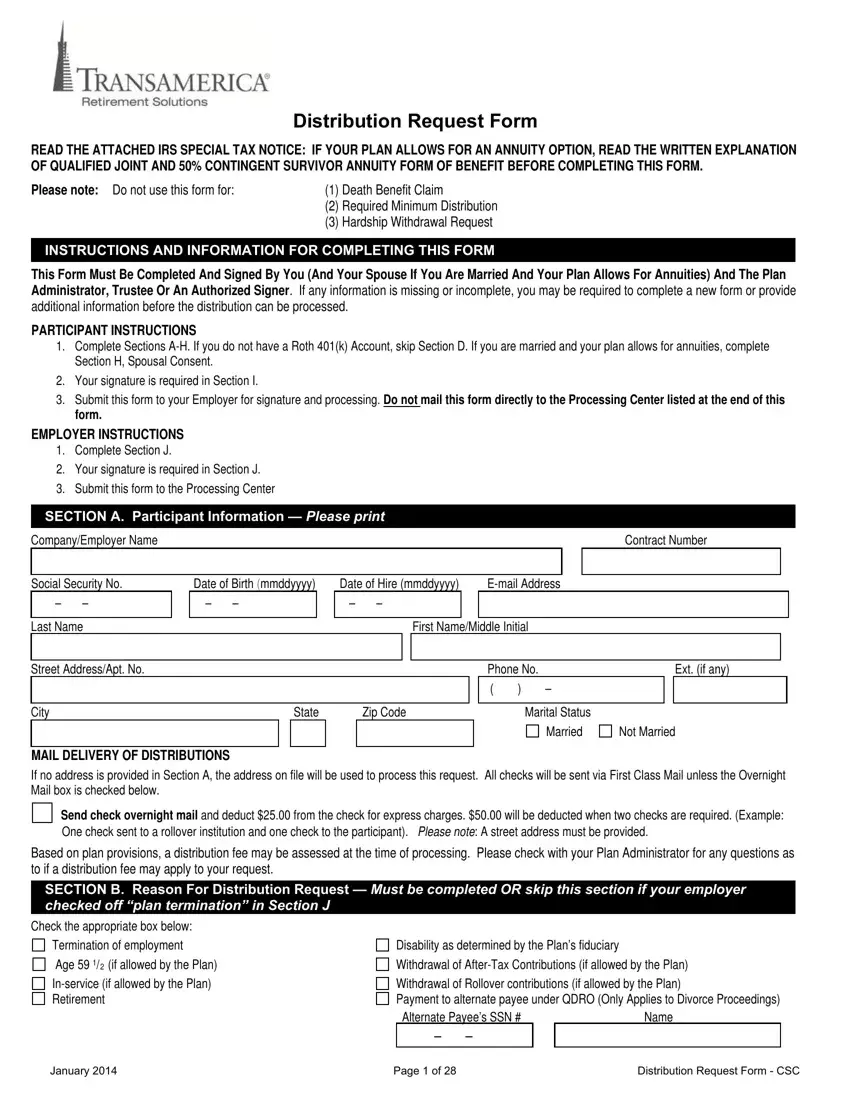

Transamerica 401k Withdrawal Fill Out Printable Pdf Forms Online